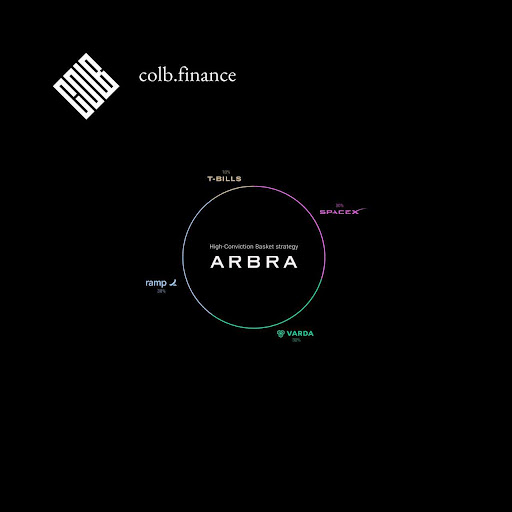

London, UK, 27th June 2025, Arbra Partners Group (“Arbra”), the global financial services company, has confirmed the introduction of its leading strategy, ‘High Conviction Basket’, via Colb Asset SA’s blockchain-agnostic web portal. The actively managed portfolio—which includes a cherry-picked collection of high-growth private technology companies like SpaceX, Ramp, Varda, and more—will be tokenized as an Actively Managed Certificate (AMC).

This strategic partnership with Colb, a Swiss-based leader in real-world asset (RWA) tokenisation, is a significant step toward democratizing access to private market investment opportunities. Using blockchain technology, Arbra and Colb are allowing institutional-grade financial products to be securely and transparently accessed on-chain through Colb’s non-custodial web application.

Connecting the Dots Between VC Insight and HF Precision goal of the High Conviction Basket strategy is to discover and invest in the leaders of categories in the market: companies solving real-world problems in large markets that are supported by top-tier investors and showing extraordinary traction. Hybrid investment model The approach is part of a hybrid investment model that strikes a balance between the long-term investment focus of venture capital and the analytical rigour of hedge fund management.

Philip Harris, Chief Executive of Arbra, commented: “We fully embrace the potential of digital innovation alongside our commitment to relationship-driven client service. This partnership with Colb enables investors to access our proven high-conviction strategies via tokenisation, unlocking new opportunities in the digital investment landscape.”

Lucas Bitencourt, Founder of Arbra, added: “Arbra is not merely adapting to the future of finance—we are helping to shape it. Tokenisation is just one of the many ways in which we are helping our clients navigate and benefit from the shifting investment landscape.”

Tokenising Private Markets for a Broader Audience. For Colb, the launch of this AMC represents a key milestone in the expansion of its tokenised investment offerings. Known for enabling traditional asset exposure through blockchain-based infrastructure, Colb is now opening up access to premium private market investments traditionally reserved for institutional clients.

Yulgan Lira, CEO of Colb Asset SA, said: “At Colb, we are redefining access to financial markets through the power of blockchain. Partnering with Arbra allows us to bring trusted, high-quality investment strategies—previously limited to family offices and private banks—into the hands of a broader investor base, entirely on-chain.”

About Arbra Partners — Arbra is an international financial services group. In a market that’s increasingly complex and impersonal, we believe transparency, trust, and a pragmatic approach will always deliver better results for our clients. We deliver advice and strategies that are painstakingly tailored to safeguard and grow our clients’ wealth. Established in 2022, the group has offices in London, Geneva, and Lisbon and now has over $1.5 billion in assets under management and 26 employees. For more information, visit arbra.global.

About Colb Asset SA

Founded in 2020 in Geneva, Colb Asset SA is redefining global investing through the tokenisation of real-world assets. Colb’s suite of compliant, secure, and high-efficiency solutions connects institutional investors with traditional premium assets, fully accessible on-chain. Products include the Colb Managed Token (CMT), Colb Tracker Token (CTT), and Colb Fund Token (CFT), offering institutional-grade strategies through a decentralised lens. For more information, visit colb.finance.

Media Contact:

Company Name: Arbra Partners

Website: www.arbra.global

Contact Person: Philip Harris [Chief Executive Officer]

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No The Money Fly journalist was involved in the writing and production of this article.